You signed in with another tab or window. Reload to refresh your session.You signed out in another tab or window. Reload to refresh your session.You switched accounts on another tab or window. Reload to refresh your session.Dismiss alert

Mama Exchange is a decentralized exchange (DEX) built on the Flow blockchain that offers many type of trading options: Automated Market Maker (AMM) and Spot Trading and have a plan to open other trading types like Margin Trading, Future Trading.

Inspiration

Uniswap V3(Concentrated liquidity)

Concentrated liquidity acts as a mechanism that lets the market decide the distribution of liquidity. Liquidity Providers can allocate their liquidity to custom price ranges, ensuring higher efficiency of liquidity for the pool and a higher reward for Liquidity providers.

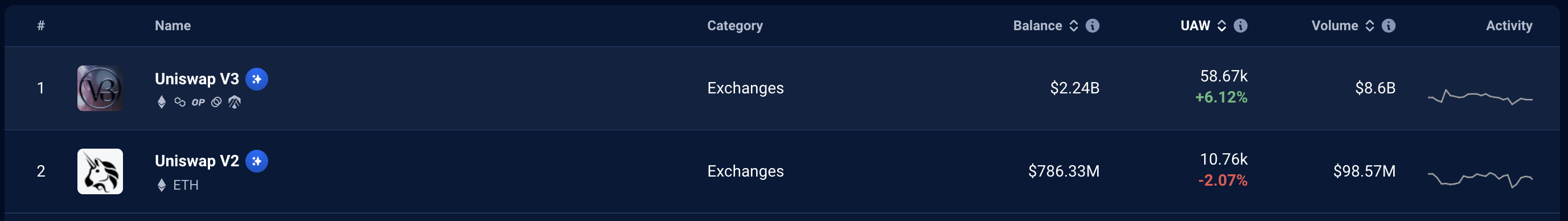

The efficiency of liquidity: Statistics data also shows UniswapV3 has liquidity of 2.4B and a volume is 8.6B per day with the volume being four times greater than liquidity. In comparison, UniswapV2 has liquidity of 786M but the volume is only 98.75M, which is only 1/7 times compared to liquidity. Check the data here.

More reward: Liquidity providers on V3 receive a higher Annual Percentage Rate (APR) compared with V2. For instance, Users provide liquidity for ETH/USDC with a price between 1000USD/ETH to 2000 USD/ETH can receive up to 96% APR. This is an incredibly high reward. Check the data here.

Centralized Exchange

CEX(Centralized Exchange) provides various of trading including Spot Trading(Market Trading, Limit Trading), Margin Trading, and Future Trading which are very convenient for users. Additionally, CEX often offers a range of trading tools, such as charts, technical indicators, and order books, to help users make the right trading decisions. By incorporating these tools into DEX, we can encourage greater user participation in decentralized finance (DeFi) on Flow.

However, users on CEX need to deposit their funds, and many now desire greater control over their funds. By building a DEX on Flow, we can empower users to maintain full control over their assets while enjoying the convenience of CEX's trading tools.

Problem statement

There is no AMM Concentrated liquidity on Flow.

There is no Spot Trading, Margin Trading, Future Trading on Flow

AFAIK, There are no DEX on flow that provides trading tools: Charts, technical indicators and order books ... like a CEX

Proposed solution

Here is summary MamaEx features compared with Blocto and Increment

Features

MamaEX

Blocto

Increment

Trading types

AMM (Concentrated liquidity), Spot Trading

AMM

AMM

Capital Efficiency

AMM (Concentrated liquidity)

Basic

Basic

Pool fee

Different pool fee for token pairs

No

No

Oracle Price

Provides history up to 10 days

No

N/A

NFT Generation

Available for Liquidity Providers

No

No

Trading tools

Charts, technical indicators, and order books, Swap

Basic

Good

Order types

Market Order, Limit Order

No

No

Future Trading

Planned

No

No

Margin Trading

Planned

No

No

Borrow/Lending

Available for Liquidity providers

No

Yes

Impact

Spot Trading: (Market Order, Limit Order) increases the diversity of trading options available on the Flow network

AMM (Concentrated liquidity): Increases the efficiency of capital usage for liquidity providers, resulting in more liquidity being available on the network.

Pool fee: Provides more flexibility for liquidity providers to choose the most appropriate pool fee for different token pairs, potentially attracting more liquidity to the network.

Oracle Price: Provides history up to 10 days that allows other DeFi dApps to build on top of MamaEX's Oracle Price, potentially attracting more developers and users to the Flow network.

NFT Generation for liquidity providers: Flow is one of the best NFT blockchain network. This is another reason why user need an NFT on their wallet.

Trading tools: Charts, technical indicators, and order books that improves the user experience for traders and makes the Flow network more competitive with centralized trading platform.

- Create Libraries: Tick, TickMath, LiquidityMath, PriceMath, SwapMath - Create Pool factory and Pool fee - Prove Liquidity - Swap - Fee calculation - Collect fee/protocal fee - NFT genaration - Oracle History price

8 weeks

6 weeks

20k

3. Smart Contract (Spot Trading)

- Setup market pairs - Market order - Limit Order

2 weeks

10k

4. Frontend

- Connect Wallet/ Footer/Header/Language selection UI - Swap UI - Provide Liquidity UI - Spot Trading UI - Wallet UI - Mobile - API swap integration - API market integration - Liquidity Price Chart

8 weeks

15k

5. Backend

- Swap cache data API - Swap SDK - Spot Trading API - Spot Trading SDK - Market API for the price Chart

4 weeks

15k

6. Deployment fee

- Deploy Swap to mainnet - Deploy Spot Trading to mainnet

2 weeks

5k

Total funding proposed: 70k USD

Development Status

Development Status

Percentage Complete

UI Design

100%

Frontend

48%

MMI Smart Contract(Concentrated liquidity)

30%

Spot Strading

18%

Backend

0%

Deployment

0%

Team

Mama Exchange is powered by a team of highly skilled and passionate engineers who are dedicated to building innovative blockchain products.

Our team is comprised of original WAX blockchain developers who have also built and launched successful Dapps, such as the cloud wallet, Bridge, NFT MarketPlace, NFT Front Store, Defi... We also have been working with DEX.

Please contact us by the following email we will provide more info about the team, progress status, and project repo.

Hi @MamaExchange - thanks for submitting this grant proposal. We are presently making changes to the grant program and application process and as a result have not been able to review this. Once the grant program submissions are opened up again we will follow up and let you know next steps. Thanks for your patience.

We appreciate your proposal. After careful review we've decided not to proceed at this time. Please stay connected to our Twitter and working groups to stay on top of the latest developments in the ecosystem and new grant opportunities.

MAMAEx

Grant category

Description

Mama Exchange is a decentralized exchange (DEX) built on the Flow blockchain that offers many type of trading options: Automated Market Maker (AMM) and Spot Trading and have a plan to open other trading types like Margin Trading, Future Trading.

Inspiration

Uniswap V3(Concentrated liquidity)

Concentrated liquidity acts as a mechanism that lets the market decide the distribution of liquidity. Liquidity Providers can allocate their liquidity to custom price ranges, ensuring higher efficiency of liquidity for the pool and a higher reward for Liquidity providers.

The efficiency of liquidity: Statistics data also shows UniswapV3 has liquidity of 2.4B and a volume is 8.6B per day with the volume being four times greater than liquidity. In comparison, UniswapV2 has liquidity of 786M but the volume is only 98.75M, which is only 1/7 times compared to liquidity. Check the data here.

More reward: Liquidity providers on V3 receive a higher Annual Percentage Rate (APR) compared with V2. For instance, Users provide liquidity for ETH/USDC with a price between 1000USD/ETH to 2000 USD/ETH can receive up to 96% APR. This is an incredibly high reward. Check the data here.

Centralized Exchange

CEX(Centralized Exchange) provides various of trading including Spot Trading(Market Trading, Limit Trading), Margin Trading, and Future Trading which are very convenient for users. Additionally, CEX often offers a range of trading tools, such as charts, technical indicators, and order books, to help users make the right trading decisions. By incorporating these tools into DEX, we can encourage greater user participation in decentralized finance (DeFi) on Flow.

However, users on CEX need to deposit their funds, and many now desire greater control over their funds. By building a DEX on Flow, we can empower users to maintain full control over their assets while enjoying the convenience of CEX's trading tools.

Problem statement

Proposed solution

Here is summary MamaEx features compared with Blocto and Increment

Impact

Milestones and funding

Total funding proposed: 70k USD

Development Status

Team

Mama Exchange is powered by a team of highly skilled and passionate engineers who are dedicated to building innovative blockchain products.

Our team is comprised of original WAX blockchain developers who have also built and launched successful Dapps, such as the cloud wallet, Bridge, NFT MarketPlace, NFT Front Store, Defi... We also have been working with DEX.

Please contact us by the following email we will provide more info about the team, progress status, and project repo.

The text was updated successfully, but these errors were encountered: